The Italian home improvement market is strongly influenced by the fact that traditional specialist retailers for hardware and household goods – “ferramenta e casalinghi” – still have a relatively strong presence. If you look at the DIY sector in the narrower sense, cooperatives of independent retailers or retail groups play an important role.

If we take the number of locations as a criterion, the Sistema group, which includes the Bricolife cooperative and the Brio Io franchise chain, ranks first: Of the 770 retail outlets in the entire DIY sector in Italy, 26 percent are accounted for by the two Sistema partners (Brico Io 15 percent, 118 stores, Bricolife 11 percent, 87 stores). The figures are taken from the “Monitoraggio GDS Brico & Garden” study by diyandgarden.com, using data from the market research company GfK. Also worth mentioning here is the Brico OK franchise group with 119 stores (15 percent).

However, this cannot hide the fact that a foreign corporation now occupies a dominant position in the Italian DIY market: the French Adeo Group operates almost a fifth (19 percent) of all Italian DIY stores. It is represented in the country with three sales channels.

The dominant position of the French becomes particularly clear when looking at the distribution of sales areas. Its main sales channel, Leroy Merlin, has the largest share of the 2.211 million m² available to DIY stores in Italy, with 20 percent (442,000 m²).

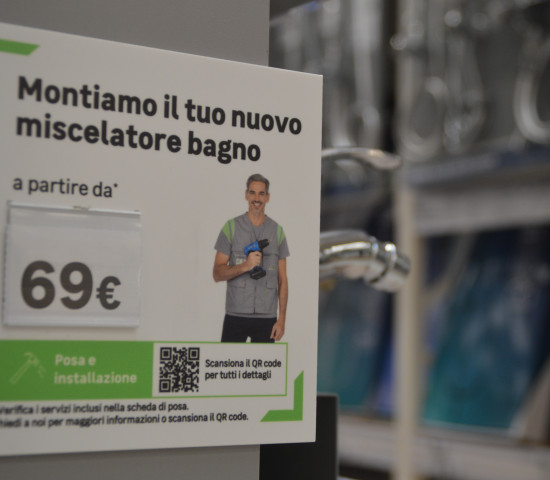

The Tecnomat sales channel (11 percent, 246,000 m²) is attracting a lot of attention in the industry with its radically simple concept tailored to professionals and semi-professionals (which was called Bricoman until 2022 and operates under the Obramat brand in Spain and Obramax in Brazil). With Bricocenter as its third sales line, Adeo is also active in the Italian market as a franchise provider.

Menü

Menü

Newsletter

Newsletter