The growth in sales of the DIY stores was only half as great at 6.5 per cent, however, although the growth generated by their online business was 111 per cent. The DIY retailers' bricks-and-mortar stores realised total sales worth EUR 20.839 bn, equivalent to a share of 67 per cent of the market. Their e-commerce sales came to EUR 938 mio, accounting for 3 per cent of the overall market.

The second-largest market share, namely 14 per cent or EUR 4.447 bn, belongs to the pure players in online retailing. As an overall segment they also enjoyed the highest growth with an increase of 84 per cent.

The speciality trade grew by 4.2 per cent to a sales volume of EUR 4.074 bn, finishing just behind the online retailers with a market share of 13 per cent. Despite growth of 7.7 per cent, the DIY category of the supermarkets continues to play a minor role, accounting for a market share of 3 per cent (EUR 805 mio).

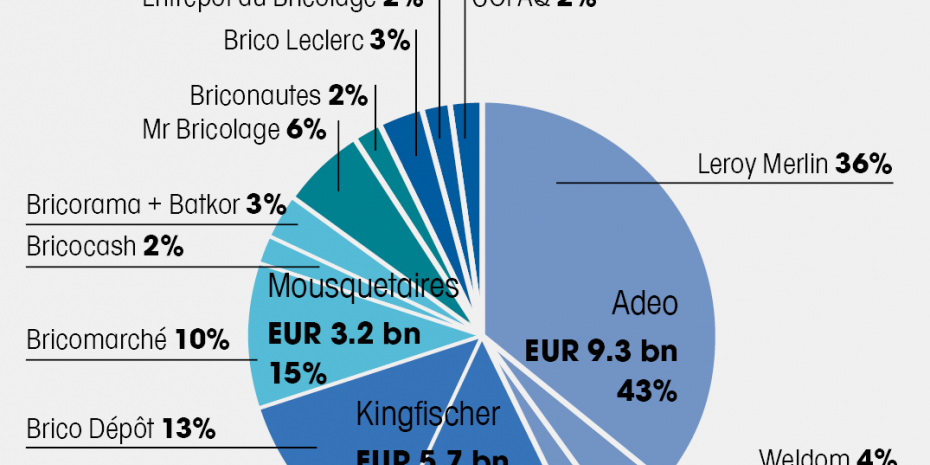

Even though the DIY stores have made such phenomenal gains on the Internet, the entire industry seems to be looking very nervously at the big competitor from the USA. During the question and answer session at the press conference, neither Inoha president Jean Luc Guery nor FMB president Mathieu Pivain, head of asset management at Kingfisher in France, wanted to comment on Amazon, not even to mention its name. They only mentioned "the company that pays no taxes in France".

Menü

Menü

Newsletter

Newsletter