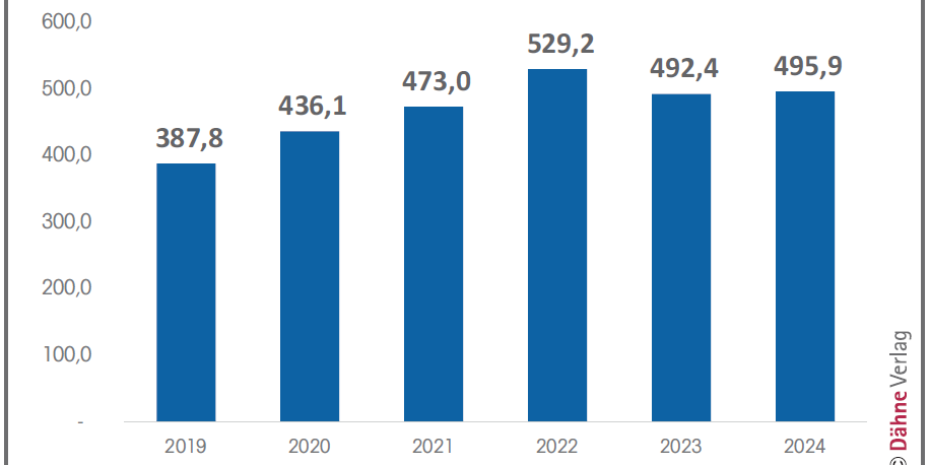

As we all know, a problem shared is a problem halved: 2024 was a rather mixed year for the industry, not only in Germany but also internationally. The global home improvement market shrank by an average of 1.9 percent last year, while the global DIY market, which is most comparable to the DIY store business, achieved a slight increase of 0.7 percent.

The main reason for the relatively poor performance in 2024 was China. While the Middle Kingdom had saved the global market from a more severe decline in 2023, it is now pushing the entire Asia/Pacific region and the global market into negative territory with a decline of 15.4 percent. In contrast to the global trend, nominal sales in the home improvement market in North America and Europe grew slightly in 2024, with increases of 1.6 percent and 1.2 percent, respectively. Without the sharp decline in China, the global home improvement market would have grown by 1.5 percent in 2024. In 2023, global sales had already shrunk by 4.6 percent, with the Chinese market protecting the international home improvement industry from an even sharper decline.

The DIY market performed slightly better than the home improvement market in 2024. Globally, the DIY market grew by 0.7 percent, with growth of 1.0 percent in North America and Europe and only a slight decline of 0.4 percent in the Asia/Pacific region. In contrast to the DIY market, the larger home improvement market also includes building materials retailers and furniture retailers with a DIY character, but not pure furniture retailers.

The figures are taken from the new edition of the Home Improvement Reports Retail Worldwide, which was published on October 15. The figures for the international home improvement and DIY industry are published by Dähne Verlag and were once again compiled in collaboration with the global trade associations EDRA/GHIN and the global manufacturers' association HIMA.

“We are pleased to be able to provide the international industry with a comprehensive market overview again this year,” explains Reinhard Wolff, President of the international manufacturers' association HIMA. “We are undoubtedly in challenging times, in which reliable data and figures are essential as a guideline for all involved,” says Wolff.

Menü

Menü

Newsletter

Newsletter