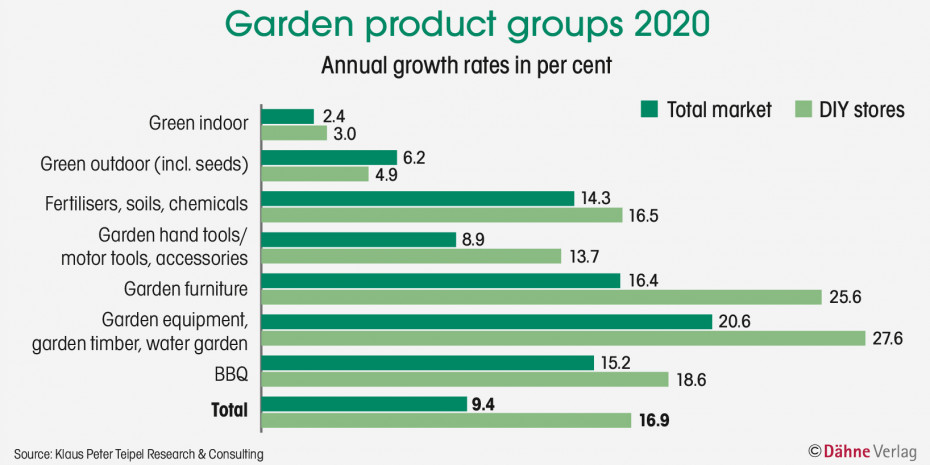

With these figures, home improvement stores proved to be the best-performing in particular of all the garden distribution channels, because the overall German garden market grew by a "mere" 9.4 per cent. Another related factor here was that speciality garden centres did well, but not quite as well, increasing their sales by 7.1 per cent in 2020. One reason for this was that these outlets had to close in some federal states during the first coronavirus wave in March and April, while supermarkets were permitted to carry on selling their bedding and balcony plants.

Looking at the individual product groups, it is clear from the data that if Germans had to stay at home during a pandemic-blighted spring and summer, they intended to do up their gardens (and balconies or patios). Spending on barbecues increased by 15 per cent, garden furniture sales were up 16 per cent and garden equipment by 21 per cent (pools sold out, for example).

What will happen in 2021? Teipel predicts that garden range sales will probably decline in Germany, by 2.7 per cent overall and by 2.5 per cent in home improvement stores. That still means, however, that the market as a whole will remain on a high. If the record year of 2020 is regarded as a significant outlier, 2021 will develop extremely positively compared with the preceding years…

Menü

Menü

Newsletter

Newsletter