So the chapter on the USA is fittingly thick in another standard work with whose help the international industry finds out about players on the market: the trade directory DIY Retailers worldwide by the German publishing house Dähne Verlag lists 36 companies on the US market. Experts at the German specialist publishing house only count more in Germany itself, one of the most highly competitive retail markets there is and the second largest market in the world.

Incidentally, these two countries have something else in common: foreign traders find it difficult to gain a foothold here. Only American companies operate in the USA, in Germany there have only been some Screwfix branches of the British Kingfisher group since 2014, stores from the Swedish chain Clas Ohlson since 2016 and again the Swedish chain Rusta since 2017.

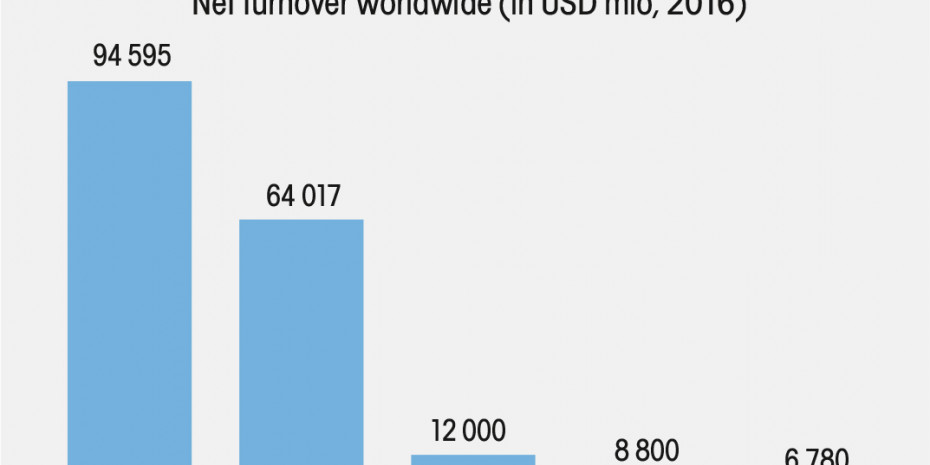

But back to the USA. Even though it is, of course, dominated by the major names Home Depot, Lowe's, Menards, Ace Hardware or Do it Best, the image of the US market is much more colourful - this can be clearly seen in the USA chapter in Volume 2 of DIY Retailers worldwide. Even industry insiders - especially the non-Americans - will not be too familiar with names like Higginbothams, Ritter Lumber or Sutherlands.

But such trading companies make up the American market. After all, we're not talking about only small chains like Friedman's with merely four locations, or medium-sized ones like Southern Fastening with around 130 stores; moreover we're talking about lesser known heavy-weights, such as Northern Tool with almost 100 stores and annual sales of more than a billion dollars, or the paint specialist Sherwin-Williams who, with its almost 4 000 stores in the USA and more in Canada and Puerto Rico, achieves sales with its Paint Stores Group of almost seven billion dollars.

Menü

Menü

Newsletter

Newsletter