The group's primary distribution channel B&Q performed poorly in its domestic market in Great Britain and in Ireland, where sales were down by 2.8 per cent and by 3.0 per cent on a like-for-like basis. A bigger downturn was experienced by the Castorama stores in France, with sales falling by 7.3 per cent and by 7.1 per cent in like-for-like terms. However, Brico Dépôt in France achieved growth of 1.4 per cent.

The Screwfix distribution channel continued to perform well, growing by 10.3 per cent (like-for-like: 4.1 per cent) in Great Britain. As a result, Kingfisher has revised its expansion plans for this channel upwards from the 700 stores originally planned to 800 outlets in total. It currently operates 627 Screwfix stores there. The 19 Screwfix stores in Germany, which are to be closed (see separate report) saw an increase in sales of 8.3 per cent and of as much as 9.1 per cent on a comparable store basis. Apart from these outlets, Kingfisher intends to close another 15 stores in all.

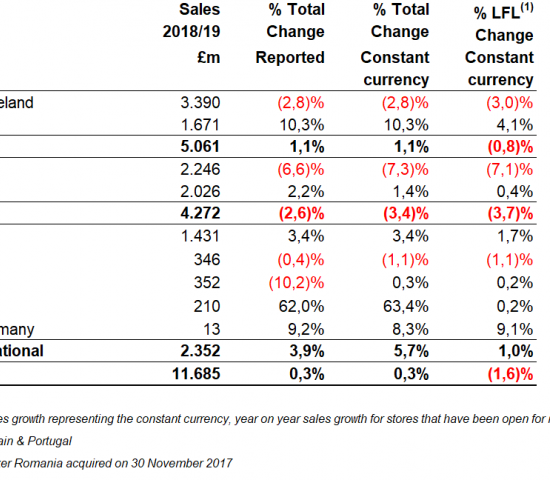

Detailed sales figures for each country are shown in the enclosed table.

In its 2018/2019 annual report, Kingfisher outlined the progress made with its transformation process under the title "One Kingfisher". The proportion of products in the unified range now stands at 44 per cent (based on COGS - cost of goods sold). The implementation of a unified IT platform is largely complete, benefiting e-commerce operations. Online sales rose by 17 per cent and now account for 6 per cent of group sales. Click & Collect sales at B&Q increased by 42 per cent, chiefly due to the new supply time of one hour.

Menü

Menü