Bigger and faster than DIY

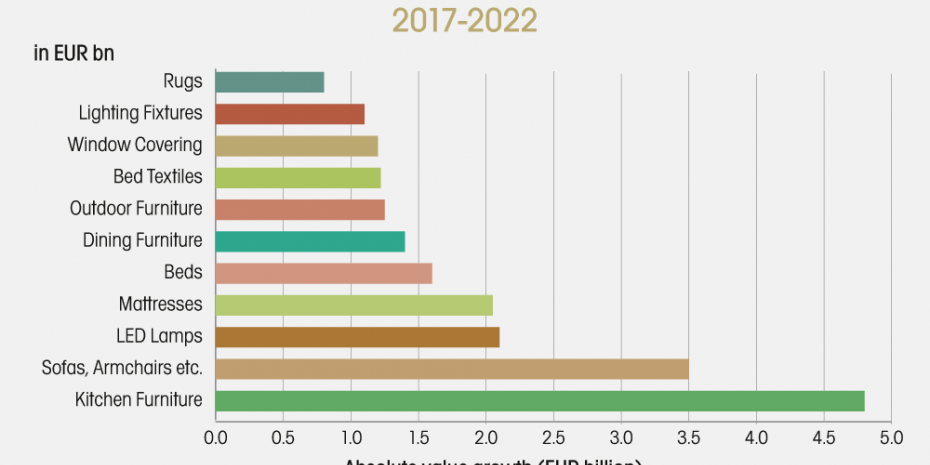

DIY players looking to make gains through product diversification should concentrate their efforts on a few categories that are forecast to win big over 2017-2022. Aside from furniture, LED lamps and lighting fixtures will be key growth categories, as consumers switch on to smart lighting. Combined, these two categories are expected to increase by more than EUR 3 bn in retail value sales in Europe over 2017-2022. Other fast-growing categories include rugs and window coverings (i.e. blinds and curtains), both growing by more than a 3 per cent value CAGR over the next five years.

The bed category is also forecast to showcase expansion, with mattresses, bed frames and bed textiles rising by almost EUR 5 bn, cumulatively. Bed-in-box companies (e.g. Simba, Eve, Casper etc.) have disrupted mattress sales in Europe, altering typical mattress shopping behaviour by lowering unit prices and moving sales from physical bed stores to websites.

DIY stores have traditionally been known to sell paint, power tools and gardening supplies, but retailer strategies that go beyond core categories may be the key to growing the customer base in the future. A number of high profile M&A transactions suggest that retailers both inside and outside the DIY industry are recognising the need to capture demand all along the renovation/decoration process. In a departure away from its traditional product mix, Home Depot acquired The Company Store, a popular home textiles online retailer…

Menü

Menü

Newsletter

Newsletter