We can all remember much-touted technologies that generated lots of buzz but never seemed to gain traction in reality or deliver measurable real-world results. Happily, in the case of AI-based, data science-driven price optimisation, there are plenty of high-impact deployments that are generating exciting - and measurable - business results for retailers.

Example #1: enhanced margins

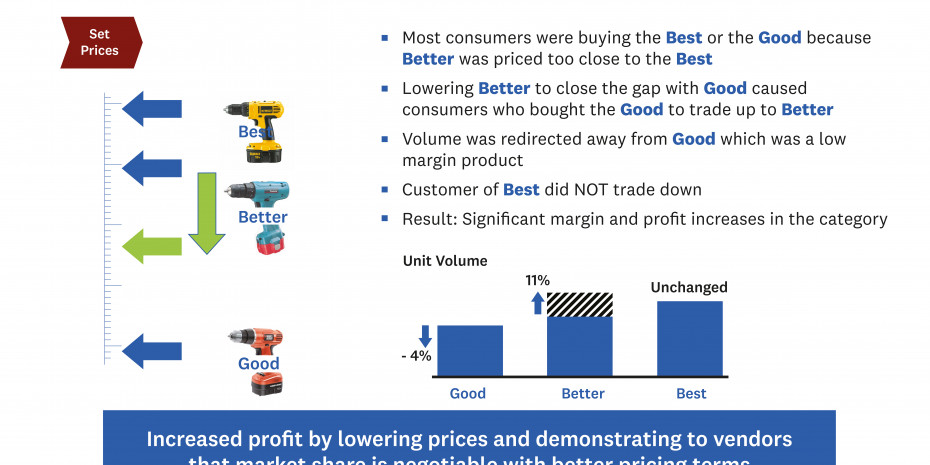

Let's look at some examples in the DIY arena that I have personal experience with. In our first example, a category manager at a UK DIY retailer wanted to leverage insights from the price optimisation system to enhance margins across the category for electric drills. Their main three offerings fell into the good/better/best levels, with the good drills selling for GBP 89, the better drills for GBP 119 and the best for GBP 129. The price optimisation's analysis of demand signals indicated significant price elasticity for the good and better drills and relatively low elasticity for the best drills. With the benefit of some what-if scenario planning, the pricing team demonstrated to the category manager that reducing the price on the better drills would attract a number of would-be good buyers to the better category, while not cannibalising sales in the best category. The price analysts recommended a GBP 10 reduction in better prices.

Armed with this data-driven recommendation, the category manager negotiated a cost reduction with the better category drill supplier that would partially offset the GBP 10 price reduction. Real-world results dovetailed with the forecast as demand for low-margin good drills fell by 4 per cent as shoppers migrated to the better option, which even after price cuts yielded a higher margin than the good drills.

In fact, unit sales of better drills ticked up an impressive 11 per cent, attracting market share from buyers who not only switched from good but from better-level offerings at competitors. Sales of the premium-margin best drills remained unchanged, yielding a substantially improved overall blended margin and delivered enhanced unit sales for the better drill supplier.

Example #2: rebalanced prices

In our second example, a large US DIY retailer leveraged data science-driven price optimisation to holistically rebalance prices across the ceiling fan category. Again, the category manager and price analyst teamed to take advantage of what-if scenario capabilities to assess the impact of applying the price recommendations generated by the tool.

Menü

Menü

Newsletter

Newsletter