The opening of the first B&Q in the Republic of Ireland seems to be stirring up the small but fast-growing Irish DIY market

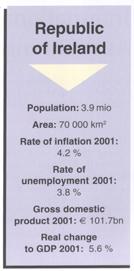

Growth in gross domestic product has averaged 9 per cent per annum over the five years to 2000. Certain sectors such as construction have outstripped even that, with annual growth rates of 15 per cent. DIY retail growth has reflected these trends, driven on by a housing boom – which has rapidly increased prices and building figures too.

As in Britain, DIY has become a culturally popular activity, with a proliferation of TV programmes and consumer magazines designed to encourage DIYers to refurbish and improve their homes.

Woodie’s is determined to maintain its leadership in the Irish DIY market.

Increasing affluence is leading to two important results: firstly many people are refurbishing their holiday homes, and so fuelling the demand for DIY products. Secondly there is a trend for those of Irish ancestry, scattered throughout the world, whose families left Ireland in the last century, to return home with the aim of renovating property.

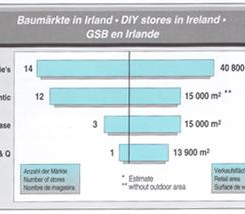

However, the DIY market remains fragmented because of the widely dispersed population, planning restrictions on out-of-town developments and a higher emphasis on local products and services. The opportunity that exists in Ireland is illustrated by some surprising gaps in the superstore coverage. The town of Limerick, for example, with a population of 60 000, has no DIY superstore. It is estimated that superstores have around 30 per cent of the market at this stage.

The planning system is a key factor in the future of the DIY market in Ireland. The government has imposed a cap of 6 000 m2 on individual superstore growth, a move that is designed to prevent any one retailer exercising monopoly power and to protect smaller retailers.

B&Q will shake up the competition in Ireland with more DIY superstores.

Meanwhile other retailers in the Irish market are also enjoying the fruits of economic success. In 1999 Homebase acquired the Hampden chain, which runs three DIY stores in the Dublin area. At the beginning of 2001 Homebase itself was bought by new owners, and it is still not clear what long-term strategy the company has for its Irish operation, although it sold one of its Irish development sites to B&Q. For the chain as a whole, the company is developing a new softer look, designed to appeal more to the female consumer. It has been suggested in the past that Homebase was not properly tuned in to the particular demands of the Irish market. However, faced with the arrival of B&Q, a new softer look is probably a good strategy for Ireland as for the UK.

Both the local DIY superstore operators are owned by builders’ merchant groups – and are now proudly positioning themselves as wholly Irish owned.

Atlantic Homecare has 12 stores around the country. It is owned by the Heiton Group of Companies, which is one of the largest industrial groups in Ireland, with builders’ merchant operations in both Ireland and the United Kingdom. When Heiton reported their financial results for the year to 31 October 2001, the company stated that Atlantic had put in one of its strongest performances to date with growth in turnover of 60 per cent and like-for-like growth of 14 per cent (including operations in Northern Ireland). The company plans one new store and one relocation in the coming year. Currently four of its stores are located away from Dublin. The market leader in Ireland is Woodie’s, owned by the Grafton Group, with 14 stores. Last year Woodie’s enjoyed a 19 per cent growth in turnover to 85.2 mio euro. Results for the first quarter of 2002 show that Woodie’s has continued to perform well, within an overall increase of 15 per cent for the Grafton Group as a whole.

Of Woodie’s 14 stores, six are situated away from Dublin. The most recent to open were Tralee, Co. Kildare and Newbridge, Co. Kerry, this spring. The company’s strategy is to open more new stores in key locations, while also refurbishing existing outlets. The company is determined to maintain a strong market position in what it sees will now become an increasingly competitive market, and is intending to grow further during the current financial year.

Both Atlantic and Woodie’s have embraced the power of the internet wholeheartedly in their attempts to drive up sales, and both companies have successful online selling operations. Woodie’s says that its direct sales business will total over 25 mio euro within five years. Their service covers 6 000 products and the company is targeting 100 000 new customers via the internet. Atlantic’s internet shopping service covers everything from home office furniture – claimed to be the largest range in Ireland – through garden products, household accessories, lighting, DIY products and furniture.

DIY in Europe 6-7/2002

Menü

Menü