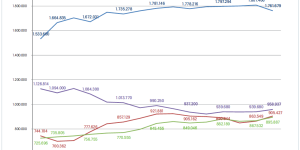

Nonetheless, retail value growth continued its downward trajectory in China over 2013-2018, falling year-on-year. Most recently, changes in the housing market have put pressure on consumer industries, including home improvement. The Chinese government's attempt to expand the amount of rental housing available to Chinese consumers has had unintended consequences, namely attracting property investors into the market which has caused a surge in rents in many cities across China. Rising rents squeeze discretionary income, leaving less money available for home improvement and home furnishing products.

Interestingly, more than 88 per cent of households in China were homeowners in 2018, however, a number of these homes (maybe as much as 20 per cent) are likely to be vacant. Property speculation is a major issue in China and the geography is thought to have some of the highest vacancy rates in the world.

In contrast to home improvement sales in Europe and North America, the product mix differs in China, due to the Do-It-For-Me nature of consumers. Floor covering (i.e. floor tiles and wooden flooring) accounted for almost half of all home improvement sales in China during 2018. Together, home paint and wall covering accounted for a further 20 per cent of home improvement retail value sales in 2018.

E-commerce players, Alibaba Group and JD.com Inc, recognise the untapped opportunities in the highly fragmented home improvement and…

Menü

Menü

Newsletter

Newsletter