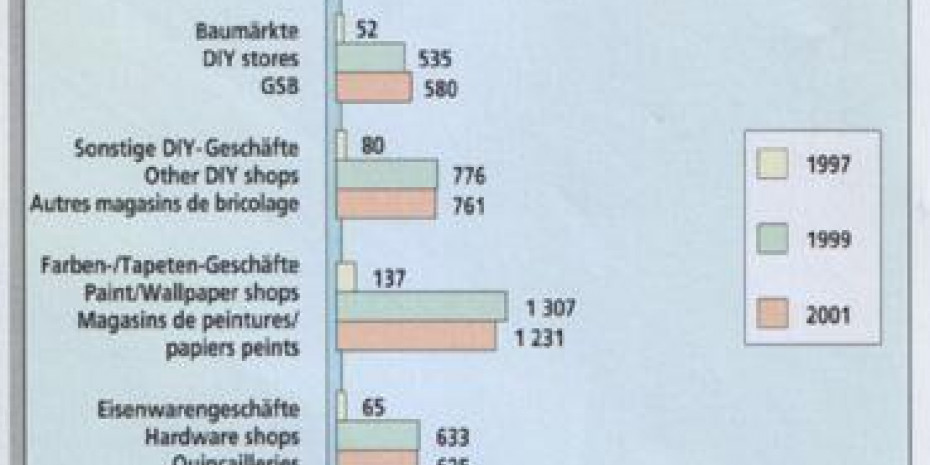

In general GfK sees a decrease in the number of DIY businesses: in 1997 there were still 3 830 DIY businesses in the Netherlands, and in 2001 just 3 715, which represents a drop of three per cent. However, the total retail area expanded by 20 per cent to 2 425 000 m2. Overall sales rose by 13 per cent, from 3.08 bn euro to 3.48 bn euro.

The number of DIY superstores increased by eleven per cent to 580. Total retail area grew by 330 000 m2 to 1 514 000 m2. This means that the average retail area in the Netherlands is now 2 610 m2. The DIY superstores achieve sales of around 2.3 bn euro; this corresponds to growth of 24 per cent and a 64.5 per cent share of overall sales. In 1997 the DIY superstores had a share of 58.9 per cent. Each DIY superstore generates average annual sales of 3.4 mio euro.

Those who operate specialty paint and wallpaper shops are having a hard time. The number of such shops has dropped by ten per cent to 1 231 over the past three years. However, their retail area has become bigger, growing by 15.3 per cent to 375 000 m2. The average retail area comes to 492 m2, which is 21.8 per cent more than 1997. Sales per square metre decreased by 15 per cent to 1 700 euro. The share of overall sales for the sector decreased by 3.2 per cent, so that it now amounts to 12.9 per cent.

Where the specialty hardware or tool shops are concerned, GfK has only considered in its report those that do not supply professional tradesmen. Their number has gone down by four per cent, so that there are only 625 such specialty shops in the Netherlands today. The total retail area has increased by two per cent, whereby the average area of a hardware shop grew by six per cent and now comes to 433 m2. Sales grew by 4.2 per cent, which means that the turnover of a hardware shop amounts to 652 000 euro. This indicates an 11.7 per cent share of overall sales for the sector, corresponding to a drop of one per cent over 1997.

Their total number went down by 5.5 per cent to 761 outlets in the case of “other shops”. Sales rose by 0.5 per cent. Sales per shop rose by six per cent to 498 000 euro and the retail area grew by an average of 22 per cent. The share of total sales claimed by the…

Menü

Menü

Newsletter

Newsletter