The housing market wealth effect and growth in the number of households are key drivers for the home paint and wall covering categories. During 2018 house prices in Europe began to level out, after a prolonged period of price hikes. While creating some relief for first-home buyers, owner occupiers were less pleased with this development. Buoyant housing values tend to make homeowners feel wealthier, creating an environment conducive to discretionary spending. In contrast, falling house prices influence households to spend less, particularly on DIY products, such as paint and wallpaper. On the bright side, some good news comes in the shape of new household growth. Between 2018 and 2023 there will be 7.85 million new households created in Europe, the majority of which will be in Western Europe. While positive, this is still lower than the 11.1 million households created in Europe between 2013 and 2018.

Subdued paint forecasts

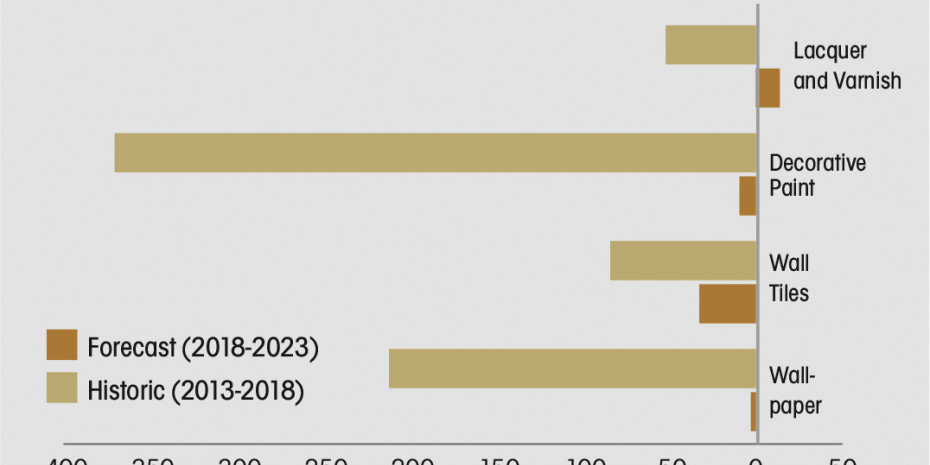

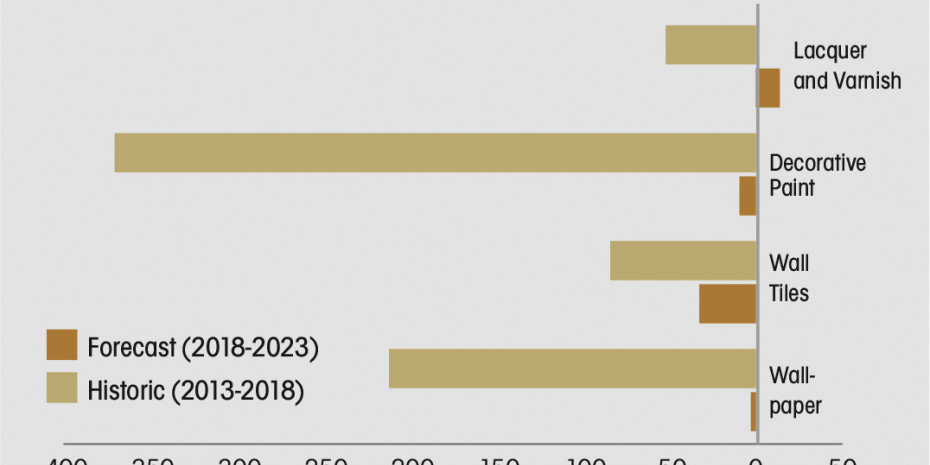

Muted macroeconomic forecasts drag down future growth prospects (i.e. 2018-2023) for paint and wall covering, although an improvement on historic (i.e. 2013-2018) performance is expected. In retail value terms, decorative paint is expected to fall by a 0.03 per cent CAGR between 2018 and 2023, albeit in constant terms (i.e. excluding inflation). Wallpaper is expected to perform more strongly than wall tiles, falling by a 0.02 per cent value CAGR over 2018-2023, compared with 0.3 per cent. In volume terms, Eastern Europe is expected to fare much better, with decorative paint sales actually rising by a 1.8 per cent CAGR in 2018-2023. On the other hand, volume growth in Western Europe will still fall below zero, shifting from a negative 1.4 per cent CAGR (2013-2018) to a negative 0.9 per cent CAGR (2018-2023), a slight improvement.

Lacquer and varnish demand

Consumption of decorative paint and lacquer and varnish diverges quite significantly. Household and cultural differences in each region result in lower per household spending on lacquer and varnish in Europe, when compared with Australasia and North America. High-density living in city centres results in a lack of outdoor space in Asia Pacific, meaning consumers are more likely to use lacquer and varnish products for wooden furniture, rather than fences and decking. The opposite is true in Australasia, where houses are more popular than apartments and gardens are the norm. This is supported by the strong correlation between outdoor furniture and lacquer and varnish (seen in the graph…