The product range at Wickes and Wickes Extra is increasingly becoming less “heavyside”.

If the UK diy market itself were to weaken, then the independent retailers would no doubt come under much more pressure. However, the housing market remains strong, the economy is continuing to grow and there is also a subtle change underway in consumer spending. Some retailers have identified a trend towards more “wants driven” than “needs driven” spending. This means that consumers are increasingly interested in aspirational and aesthetic solutions. They are spending money on their homes because they want to, not because they have to. There is a responsibility therefore on retailers to create high quality displays which create inspiration in the minds of their customers.

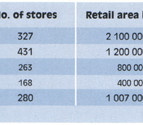

B&Q is seeking to meet these customer needs by advancing with three separate platforms. The core chain comprises nearly 200 Supercentres of around 2 800 m2 each. There are now also over 100 larger Warehouse stores. Recently B&Q opened a 15 700 m2 Warehouse in Manchester, the group’s largest store in Europe. The new Mini Warehouse concept, which now numbers 30 stores, completes the portfolio. It features many of the elements of the full concept in a smaller store. The concept is a way of updating a Supercentre store in a smaller catchment area or for outlets where planning constraints prevent the implementation of the largest type of store. B&Q intends to continue to convert some of the larger Supercentres (5 500 m2) into Mini Warehouses in the coming months.

Competitors will have a hard time competing against B&Q in the future.

B&Q is clearly going to remain a hard company to compete against in future, with a new national distribution centre ready to open next year in the UK, accelerated international expansion, and constantly improving sales and profitability.

A mix of formats has also been the approach at Focus Wickes, unsurprisingly since the company was formed out of two quite different types of retailer. Focus is the larger part of the group with 263 stores, which are currently being revamped. Some stores are being modernised, some are being closed down and some are being converted to the more project-oriented Wickes format.

The Focus stores are geared to decorative products and to maximising their appeal to female customers. Wickes complements this approach by its traditionally more “heavyside” format, which has however softened in recent years through the introduction of more display areas and an increased focus on gardening. The Wickes chain of 168 stores continues to appeal to a mix of trade and DIY custom, with a focus on building materials in addition to specific projects such as conservatories, kitchens, bathrooms and loft conversions.

High street independents account for around 40 per cent of the market.

This year has seen the continued development of Wickes Extra, a larger format store of 5 400 m2. The difference compared with a normal Wickes store is one of scale, which allows a larger number of products to be stocked, and for a much larger external display area. There are currently two Wickes Extra stores trading, a number that is expected to increase gradually.

It has also been a year of development for Homebase, now part of the Argos group. With 280 stores Homebase has gone further than all other retailers in trying to appeal to women customers. Historically favouring a soft approach, Homebase is now capitalising on this considerable advantage over its competitors. Nearly 100 of the stores now feature mezzanine floors, which provide extra space principally for bathroom and kitchen displays and so create a more attractive environment. However, Homebase television advertising continues to focus on the price message rather than on quality.

The number of Homebase stores is relatively static, as most of the company’s attention is directed towards improving the performance of existing stores. It seems likely that the chain will also benefit from once again being part of a retail group that includes the mail order and superstore retailer Argos, with which Homebase is sharing buying synergies wherever possible. The company has also announced an expansion programme in which it aims to open around ten new stores a year.

UK

Population: 59.5 mio

Area: 245 000 km2

Rate of inflation 2003: 1.3 %

Rate of unemployment 2003: 5.0 %

Gross domestic product 2003: € 1 589 bn

Real change to GDP 2003: 2.0 %

Menü

Menü