Fresh figures for the flooring market are presented by various manufacturers' associations at the Domotex every year. Particular attention is always paid to the European association of laminate flooring manufactures (EPLF): after all, the European laminate flooring producers and suppliers organised within it make up around 50 per cent of the global and - as they say themselves - over 80 per cent of the European market. So everyone sits up and takes notice when the global sales made by EPFL members in laminate flooring once again declined in 2018, namely by 4.6 per cent compared to the previous year. Even more so because in 2016 and 2017 it most recently appeared that the market was starting to recover after it had been in a slight but constant descent since 2017.

As was stated in Hanover at the EPLF annual press conference, the manufacturers organised within the association achieved global sales of 455 mio m² laminate flooring from European production. According to the association, this means that the laminate flooring market remained on a high level globally in 2018 with regional declines.

The strongest drop compared with the previous year was in Western Europe - also the home market of the association members: here sales declined by 18 mio m², i.e. 7.4 per cent. Sales were also in decline in North America with minus 4.7 mio m², i.e. minus 9.6 per cent. On the other hand, there were slightly positive developments in the regions of Asia (+ 1 mio m², i.e. 3.5 per cent) and Latin America (+ 0.5 mio m², i.e. 2.78 per cent).

Let there be light

The Light + Building trade fair, which takes place in Frankfurt at the beginning of this month, is dedicated to topics that are also important for the DIY sector

The development in Eastern Europe stagnated at the level of 2017 with 128 mio m². However, the proportions of the individual countries have shifted. As the association says, the upward trend of the previous years in Eastern Europe cannot continue, however "its stable result means this region will nevertheless continue to be an important market for EPLF producers in future".

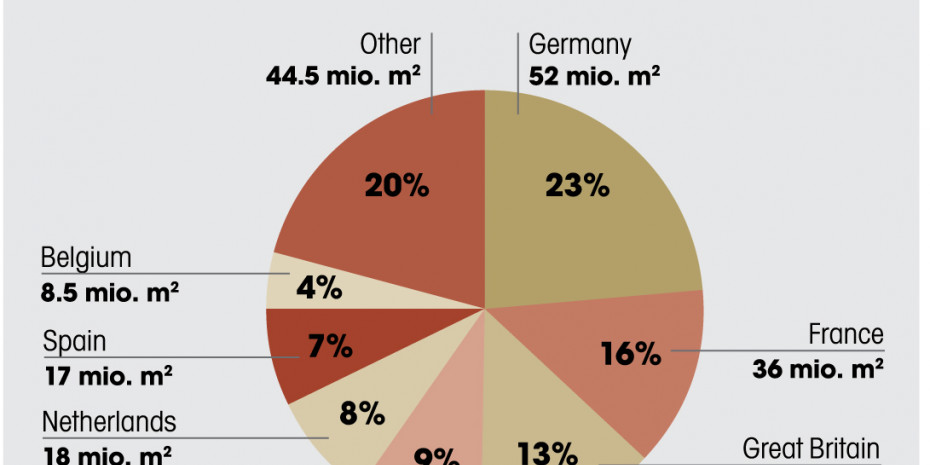

By far the most important single market in Central Europe in 2018 is still Germany with 52 mio m² (2017: 57 mio m²), albeit with a strong decline of 8.3 per cent. This was due primarily to the continuing trend towards substitution with alternative flooring types, according to the analysis of the association. France continues to take second place in Europe…

Menü

Menü

Newsletter

Newsletter