Households in South Africa continue to face financial strain as low levels of real GDP growth persist. House prices continued their ascent in 2019, up 57.3 percentage points when compared with 2010. Nonetheless, given high rates of inflation, the real increase in house prices was much lower in reality. The mortgage market is actually shrinking with the percentage of residential loans to total loans gradually decreasing from 28.5 per cent in 2013 to 23.2 per cent in 2019.

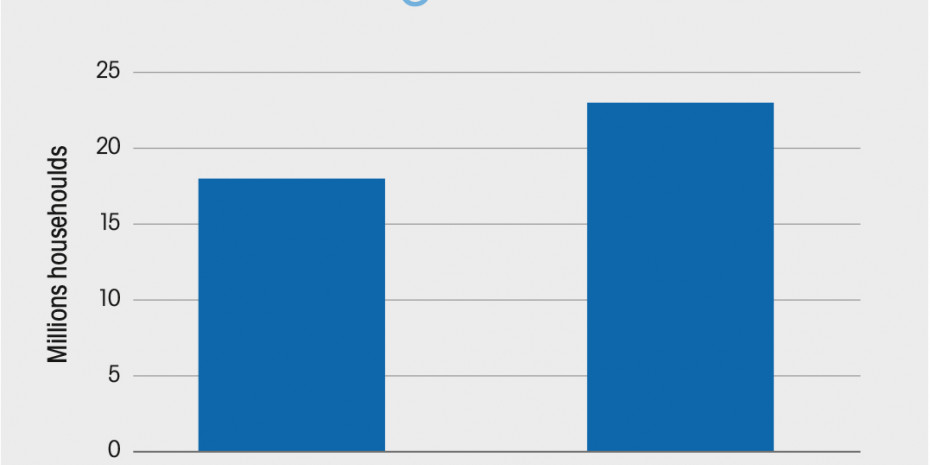

These factors have put pressure on South Africa's home improvement market, with retail value sales climbing by a modest 1.6 per cent constant value CAGR between 2013 and 2018 in local currency terms. There is a silver lining in South Africa's growth story: new household formation, roughly five million new households will be created between 2018 and 2030. Household growth gives a much-needed boost to the market's home improvement industry, with retail value sales tipped to grow by a 2.0 per cent constant value CAGR in local currency terms between 2018 and 2023.

Product and retail development

Where will that growth come from? South Africa's home improvement and gardening industry will expand by ZAR 1.5 bn between 2018 and 2023. More than 70 per cent of this absolute value growth will come from decorative paint (interior and exterior); the category which will also showcase the fastest growth of 5.6 per cent constant value CAGR between 2018 and 2023. PPG Industries Inc's Prominent Paints was the fourth ranked decorative paint player in South Africa in 2018 with an 8 per cent value share. In late 2019, Prominent Paints launched its All-Seasons exterior paint which can be used in adverse weather conditions. The water-resistant, fast-drying product can be applied to wet surfaces (i.e. in different weather conditions), making it easier for consumers to plan DIY paint jobs.

At the same time, Mica, the sixth-ranked home improvement and gardening retailer in South Africa, recently introduced its Mica Paint Centre concept in Johannesburg, showcasing the importance of decorative paint to the wider home improvement industry.

Credit challenges

Paint represents a relatively cost-effective method of sprucing up one's home, especially when compared with more expensive renovation projects which involve floor covering or bathroom and sanitaryware. Indeed, these two categories are expected to demonstrate the largest decline in retail value sales over 2018 to 2023, falling by ZAR 139 mio and ZAR 76 mio, respectively…

Menü

Menü

Newsletter

Newsletter