When observing the main product groups, more than half of the sales (51 per cent) are concentrated on the DIY assortment. The most important sales drivers here are the product groups heating/air conditioning, electrical installations and plumbing. Building materials follow with 37 per cent. The most important segments within this assortment are building materials in the narrower sense and building elements. Products connected to the garden generate sales to the amount EUR 88.3 bn and hold 12 per cent of the market share.

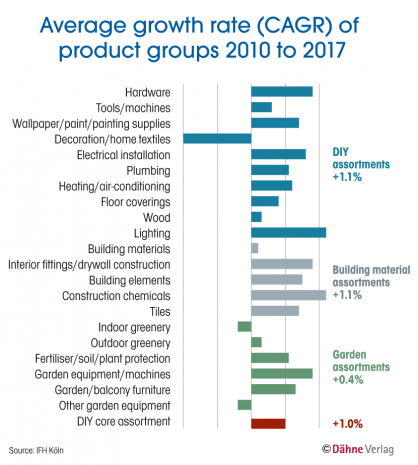

Against the backdrop of an average annual growth rate in the DIY market of 1.0 per cent between 2010 and 2017, the analysis of the individual product groups reveals very clear differences. The spectrum ranges from -2.0 per cent for decoration/home textiles up to +2.2 per cent for lighting and construction chemicals.

But the overall picture is almost consistently positive: in addition to decoration/home textile articles, only the segments garden equipment and indoor greenery are below the sales level of 2010.

A glance at the main aggregates also shows that the DIY assortment and the building materials field developed better than the greenery segment with a CAGR (compound annual growth rate) of +1.1 per cent each between 2010 and 2017. This statement applies even more clearly for 2017: the DIY assortment grew by 0.9 per cent, the building materials assortment by 4.4 per cent, the garden range records (minimum) losses of -0.1 per cent.

Germany, with sales of around EUR 149 bn (DIY core assortments) and thus a share of 21 per cent, is the most important single market in Europe. France follows with 15 per cent, Great Britain with 14 per cent and Italy with 12 per cent. Shares of between 6 and 4 per cent are held by Spain, Poland, Sweden and the Netherlands.

Of course…

Menü

Menü

Newsletter

Newsletter