Jean-Eric Riche endorsed Pivain's statement, adding that "our sector has stood fast [résister]" despite an "unsettled" [irrégulière] year".

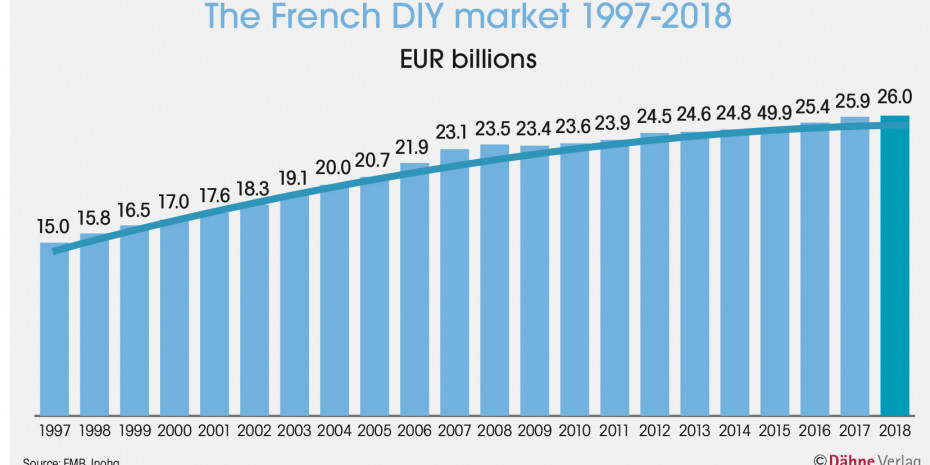

In specific terms, this means that the home improvement stores "only" sold 0.3 per cent less than in 2017. This figure was omitted from the distributed press text and only included in a chart further down.

The DIY stores are drawing a comparison here with other distribution channels. Traditional specialist shops have lost 2.0 per cent in sales, down to EUR 728 mio, DIY departments of food retailers have reported sales of EUR 547 mio, a decline of 1.9 per cent. However, these distribution channels are much smaller than the DIY store sector with its market share of 76 per cent (EUR 19.805 bn).

There were winners, too: wholesalers and builders' merchants grew their sales by 1.0 per cent to EUR 3.907 bn (equivalent to a market share of 15 per cent). Naturally, e-commerce is growing significantly, with online sales increasing by 18 per cent to a volume of EUR 1.008 bn, equating to 4 per cent of the overall market.

What nevertheless inspires optimism in the officials in the home improvement sector - out-wardly at any rate - is the comparison of the 0.4 per cent growth with adjacent segments in the general home sector. Furniture is down 2.7 per cent (around EUR 10 bn), white goods sales have declined by 0.4 per cent (around EUR 8 bn), and consumer spending as a whole is down 1.6 per cent. Only the garden market with a volume of around EUR 9 bn has (as expected) fared better and has grown by at least 0.2 per cent.

If one looks more closely at the sector and its players, it is evident that some players have not only demonstrated their "resilience" but have also made clear gains vis-à-vis competitors. This is true in the first instance of market leader Leroy Merlin of Groupe Adeo. It boosted…

Menü

Menü

Newsletter

Newsletter