But at a higher level, the home improvement retail sector relies heavily on three distinct consumer segments - do-it-yourself shoppers, professional builders and contractors, and the do-it-for-me customers. The dramatic increase in price sensitivity among shoppers is likely to persist as stubborn unemployment and furlough rates persist, while those who are still employed feel nervous about their job security and keep to a tight budget.

Darkening the picture is a predicted Covid resurgence this autumn and winter, early signs of which are already emerging in many countries. The likely result: new shutdowns, perhaps as extensive or even more extensive than those of the first phase of the pandemic.

In this scenario, DIY retailers may continue to see increased sales from homebound shoppers. Those who might normally engage a contractor for the overall job are embracing the do-it-yourself model because not only do they have more time on their hands and are keeping a sharp eye on their spending, but they are also reluctant to bring outside professionals into their living areas as disease transmission fears linger.

The net result is a mixed picture for home improvement. While overall sales will likely remain strong, predominantly driven by the largest do-it-yourself crowd, it also cannibalises at least a portion of sales from the other two groups.

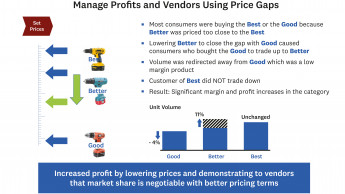

To understand and engage each of these segments effectively in a fast-evolving landscape, DIY retailers need to leverage price, promotion and markdown science to be in sync with both their commercial and retail shoppers' preferences and price sensitivities. Smart DIY retailers will tap AI-based pricing to not only structure for strong growth but also to avoid losing out to aggressive competitors.

A particular challenge currently are shopper perceptions of what is a fair price in their preferred channel or fulfilment option, whether that is online, BOPIS (buy online, pick up in-store), curbside pickup, or in-store browsing. DemandTec's recent global shopper study confirmed that now, as in pre-Covid days, price continues to…

Menü

Menü

Newsletter

Newsletter